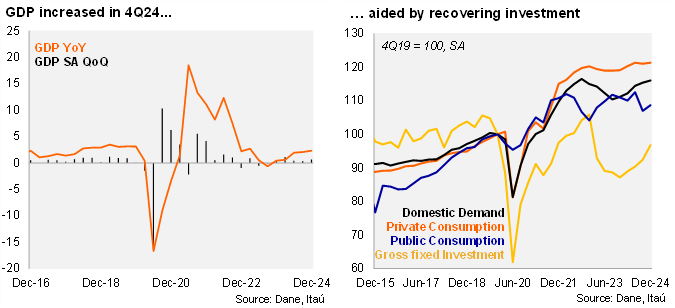

Colombia’s economy grew in line with expectations in 4Q24, with investment dynamics continuing to recover. The Colombian economy increased by 2.3% yoy in 4Q24 (+2.1% in 3Q24; revised up by 0.1pp). Annual growth in the quarter was broadly in line with the Bloomberg market consensus and our call of 2.2% yoy and the BanRep technical staff’s +2.3% yoy. In annual terms, the increase was lifted by entertainment, commerce and public administration. For the full year, activity grew 1.7%, slightly below the market consensus, BanRep expectation and our call of +1.8% (+0.7% in 2023). Sequentially, the economy increased 0.6% (SA) from 3Q24 to 4Q24 (+0.3% increase in 3Q23). Although activity continues to gradually recover, some key sectors such as construction and manufacturing remain weak, while the mining sector continued to decline.

Investment is recovering, while consumption dynamics soften. Gross fixed investment rose10.5% yoy (+3.8% in 3Q24; +4.0% in 2Q24), due to a machinery and equipment pick-up (+14.1% yoy). Total consumption increased by a mild 1.2% yoy (+0.7% in 3Q24), lifted by the private consumption rise of +1.8% (+1.5% in the 3Q24), but countered by public consumption contraction of 1.8% (-3.7% in the previous quarter). Exports increased by 2.0% over one year (+2.5% in 3Q24), while imports dynamics continued to improve, with an increase of +10.7% yoy (+12.8% in the previous quarter). On the supply side, the natural resource sector rose 3.6% yoy (+4.0% in 3Q24) lifted by agriculture, while mining fell 5.9% yoy. Non-natural resource activity increased by 1.9% (1.7% in the 3Q24).

At the margin, activity increased by 2.5% qoq/saar, up from the 1.25% registered in 3Q24. The seasonal and calendar adjusted series shows that gross fixed investment increased +20% qoq/saar (+9.3% in the 3Q24). Private consumption grew a 1.0% qoq/saar (-0.9% qoq/saar in the previous quarter). Meanwhile, imports increased by 9.3% qoq/saar (+14.4% previously). The coincident activity indicator (ISE) expanded 1.4% from November to December (SA, -1.0% m/m in November). On an annual basis, the ISE posted a mild expansion of 2.9% y/y in December. Activity in December was fueled by primary activities (2.0% YoY, 1.2% MoM) and services (3.7% YoY, 0.7% MoM).

Our Take: Activity continues to recover but not at the same pace across all productive sectors. We expect the economy to grow 2.3% this year (1.8% in 2024; 0.6% in 2023). With the activity recovery advancing and inflation pressures still strong, we expect the central bank Board to continue to follow a cautious strategy, with rate cuts of only 25bps and a year-end rate at 8.0%, above the analysts' consensus of 7.5%.